Daniela Cruickshank

New member

- Joined

- Apr 4, 2024

- Messages

- 28

- Points

- 3

StakeStone, the recently announced omni chain liquid stacking protocol backed by Binance Labs, has caught the attention of the community. So what makes StakeStone stand out? How to hunt for StakeStone airdrops? Join smsverificationphone to learn about the StakeStone project through the following article.

What is StakeStone?

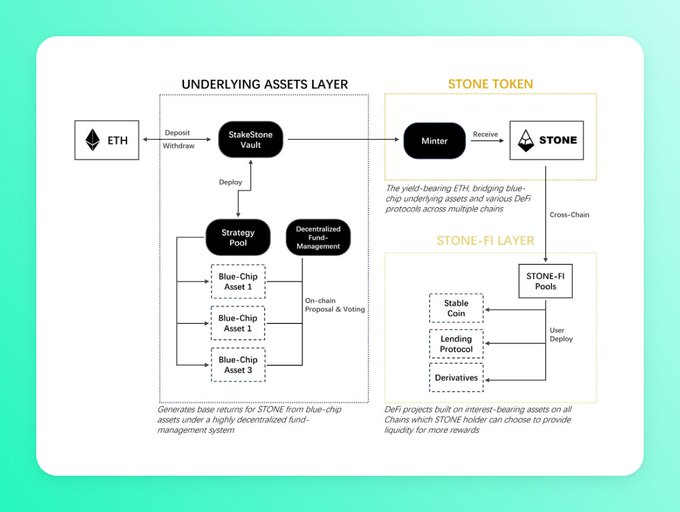

StakeStone is a multi-chain (omnichain) liquid staking protocol, allowing users to stake ETH to receive STONE (the project's liquid staking token). With STONE token, users can operate on many different chains such as BNB Chain, Ethereum, Linea…

At the same time, users holding STONE also receive APY profit rates automatically based on the Optimizing Portfolio and Allocation Proposal (OPAP) mechanism.

In addition to the staking solution, StakeStone has developed infrastructure to be compatible with the restaking protocol, allowing users to continue restaking STONE tokens to optimize capital usage.

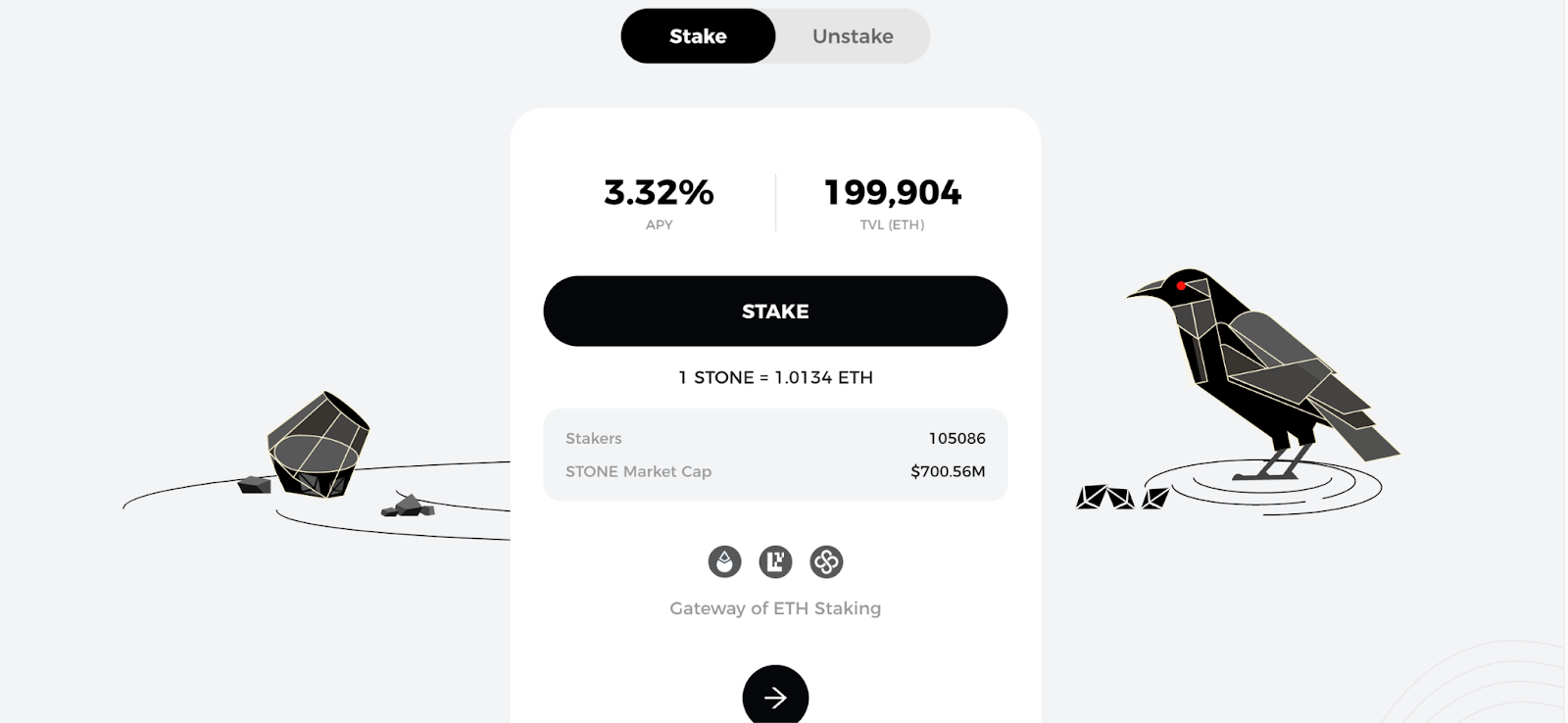

Stake is a feature that allows users to deposit ETH to receive STONE tokens and APY profit margin (about to 3 - 4%). The protocol does not stipulate a minimum stake, but if the amount of deposited assets is too low, the user's capital will not be optimal because it will be affected by paying gas fees.

After staking, users can use STONE on DeFi activities to optimize capital efficiency or participate in the STONE-Fi model. STONE-Fi provides users with different applications to use STONE tokens such as: DEX, Lending Protocol, Derivatives...

At the time of writing, STONE-Fi is providing a QuickSwap pool, allowing users to lock the STONE/WETH pair into the pool to receive G-NFT (the project has not yet announced the application of G-NFT).

In addition, users have the right to unstake through two options: Request (Send unstake request) or Instant (Unstake immediately). For Instant, if the withdrawal amount is higher than the available balance in the instant pool, users may incur slippage and gas fees.

Portfolio & Allocation: Allows users to track portfolio and allocation rates. Currently, two categories of StakeStone include: EigenLayer Native Restaking (0.1%) and Lido Staked Ether (99.9%).

OPAP: A feature that allows users to vote on proposals for project portfolios and allocation rates.

Several proposals on StakeStone's allocation ratio and portfolio changes were adopted

In the context of more and more liquid staking protocols appearing, StakeStone attracts the community when the number of minted STONE tokens exceeds 340,000 thanks to the following advantages:

Compatible with restaking protocols: Restaking is a new concept in crypto, referring to the protocol using users' staked assets to continue retaking on EigenLayer. StakeStone allocates STONE tokens for restaking solutions at a relatively low rate (0.1%), however this also promotes the ability to use capital and optimize profits for users.

Apply OPAP mechanism: Allows users to vote to control staked assets and allocation rate. Thanks to this, the protocol enhances decentralization, and at the same time, users can also have full authority to make decisions that benefit their assets.

StakeStone announced the launch of the Omni-Chain Carnival campaign, allowing users to participate in the product experience in just a few simple steps for a chance to receive airdrops in the future. According to the project, the amount of STONE tokens airdropped to users accounts for 3% of the total token supply.

The process of participating in the StakeStone airdrop referred to by smsverificationphone is as follows:

Step 1: Access StakeStone's application here.

Step 2: Connect your cryptocurrency wallet to the platform. Currently, the project supports a number of popular wallets such as: Super Wallet, MetaMask, WalletConnect...

Step 3: Select the Omni-Chain Carnival feature.

Step 4: Enter the invite code to participate in the airdrop. Users can use the following code: 03310

Step 5: Connect the user's X (old Twitter) account by selecting Connect Twitter and follow the project.

Step 6: Repost the project's airdrop post on X by selecting Retweet. After retweeting, the user selects Verify to authenticate the post.

Step 7: Users can lock the STONE token to accumulate more reward points or copy the invite code to invite friends to join.

In addition to the above steps, users can deposit STONE on the Ethereum network to receive cSTONE tokens. With cSTONE, users can continue to retake on the two restaking protocols the platform supports: Zircuit and Mode.

Token Name: StakeStone

Ticker: STONE

Blockchain: Ethereum

Token Standard: ERC-20

Contract: 0x7122985656e38BDC0302Db86685bb972b145bD3C

Token type: Updating

Total Supply: Updating

Circulating Supply: Updating

In addition to the above information, other information about total supply, total circulating supply, token allocation rate... has not yet been announced by the project smsverificationphone Insights will update you when there is notice.

On March 25, 2024, Binance Labs announced its investment in StakeStone for the development of the project. Information about the capital call or investment amount has not been disclosed.

StakeStone has established partnerships with many projects on the market such as: Hook Protocol, Merlin Chain, Polyhedra... StakeStone develops partnerships with many different projects

Swell: A project about liquid staking, supporting users to stake ETH and receive liquid staking tokens.

Jito: A liquid staking protocol built on the Solana network. Users can stake SOL tokens and receive liquid staking JitoSOL tokens.

So do you understand what StakeStone is? With the amount of knowledge that smsverificationphone provides, we are confident that this is all useful information that we bring.

What is StakeStone?

What is StakeStone?

StakeStone is a multi-chain (omnichain) liquid staking protocol, allowing users to stake ETH to receive STONE (the project's liquid staking token). With STONE token, users can operate on many different chains such as BNB Chain, Ethereum, Linea…

At the same time, users holding STONE also receive APY profit rates automatically based on the Optimizing Portfolio and Allocation Proposal (OPAP) mechanism.

In addition to the staking solution, StakeStone has developed infrastructure to be compatible with the restaking protocol, allowing users to continue restaking STONE tokens to optimize capital usage.

Features of StakeStone

Here are 3 features of StakeStone that smsverificationphone researched including: Stake, Portfolio & Allocation, Bridge.Stake

Stake is a feature that allows users to deposit ETH to receive STONE tokens and APY profit margin (about to 3 - 4%). The protocol does not stipulate a minimum stake, but if the amount of deposited assets is too low, the user's capital will not be optimal because it will be affected by paying gas fees.

After staking, users can use STONE on DeFi activities to optimize capital efficiency or participate in the STONE-Fi model. STONE-Fi provides users with different applications to use STONE tokens such as: DEX, Lending Protocol, Derivatives...

At the time of writing, STONE-Fi is providing a QuickSwap pool, allowing users to lock the STONE/WETH pair into the pool to receive G-NFT (the project has not yet announced the application of G-NFT).

In addition, users have the right to unstake through two options: Request (Send unstake request) or Instant (Unstake immediately). For Instant, if the withdrawal amount is higher than the available balance in the instant pool, users may incur slippage and gas fees.

Portfolio & Allocation

Portfolio & Allocation: Allows users to track portfolio and allocation rates. Currently, two categories of StakeStone include: EigenLayer Native Restaking (0.1%) and Lido Staked Ether (99.9%).

OPAP: A feature that allows users to vote on proposals for project portfolios and allocation rates.

Several proposals on StakeStone's allocation ratio and portfolio changes were adopted

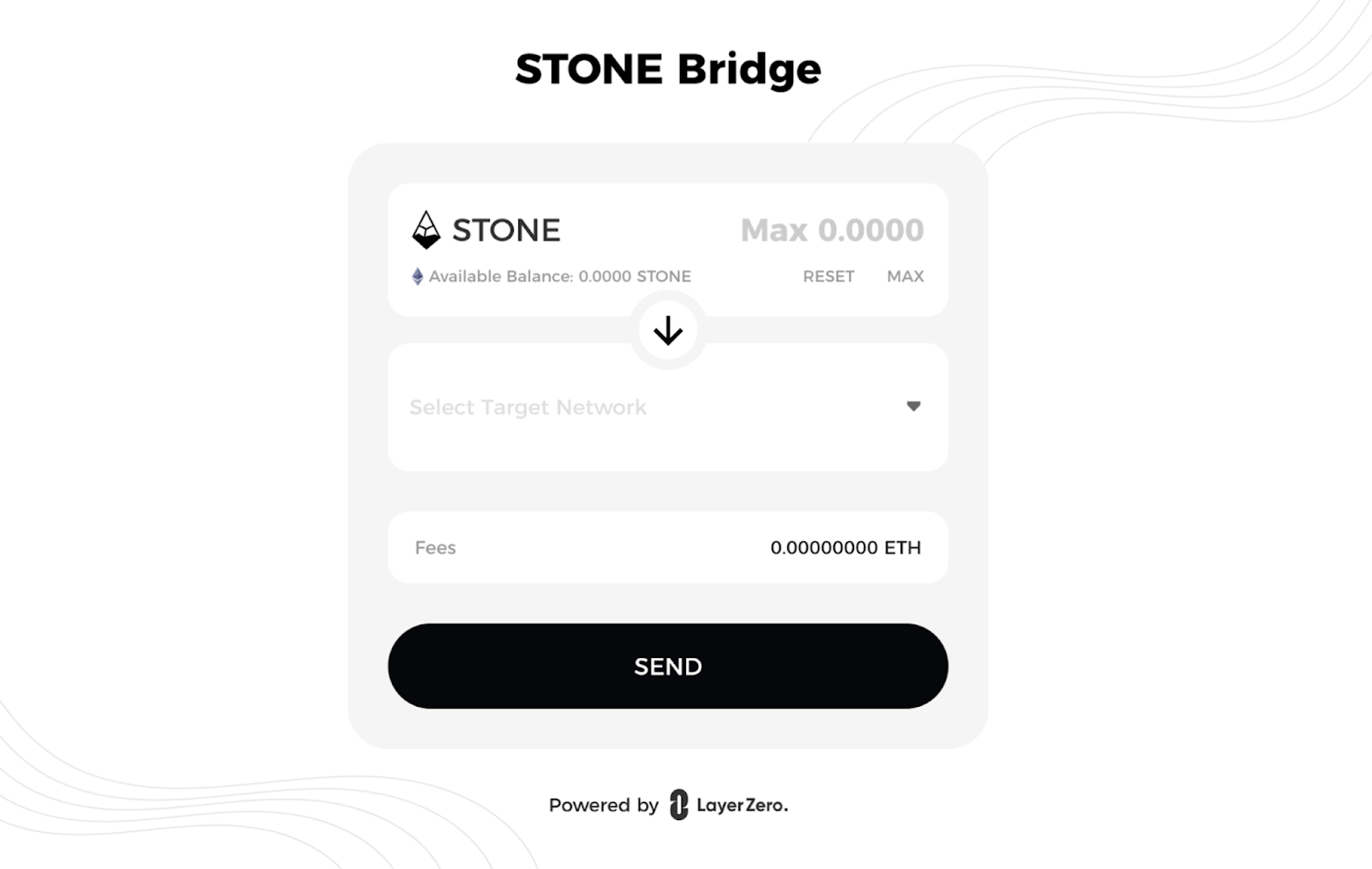

3. Bridge

Bridge allows users to seamlessly transfer STONE tokens to other networks without needing to wrap tokens. Some StakeStone networks have supported such as: Linea, Mantle, BNB Chain, Base…In the context of more and more liquid staking protocols appearing, StakeStone attracts the community when the number of minted STONE tokens exceeds 340,000 thanks to the following advantages:

Compatible with restaking protocols: Restaking is a new concept in crypto, referring to the protocol using users' staked assets to continue retaking on EigenLayer. StakeStone allocates STONE tokens for restaking solutions at a relatively low rate (0.1%), however this also promotes the ability to use capital and optimize profits for users.

Apply OPAP mechanism: Allows users to vote to control staked assets and allocation rate. Thanks to this, the protocol enhances decentralization, and at the same time, users can also have full authority to make decisions that benefit their assets.

Instructions for hunting StakeStone airdrop that learned

StakeStone announced the launch of the Omni-Chain Carnival campaign, allowing users to participate in the product experience in just a few simple steps for a chance to receive airdrops in the future. According to the project, the amount of STONE tokens airdropped to users accounts for 3% of the total token supply.

The process of participating in the StakeStone airdrop referred to by smsverificationphone is as follows:

Step 1: Access StakeStone's application here.

Step 2: Connect your cryptocurrency wallet to the platform. Currently, the project supports a number of popular wallets such as: Super Wallet, MetaMask, WalletConnect...

Step 3: Select the Omni-Chain Carnival feature.

Step 4: Enter the invite code to participate in the airdrop. Users can use the following code: 03310

Step 5: Connect the user's X (old Twitter) account by selecting Connect Twitter and follow the project.

Step 6: Repost the project's airdrop post on X by selecting Retweet. After retweeting, the user selects Verify to authenticate the post.

Step 7: Users can lock the STONE token to accumulate more reward points or copy the invite code to invite friends to join.

In addition to the above steps, users can deposit STONE on the Ethereum network to receive cSTONE tokens. With cSTONE, users can continue to retake on the two restaking protocols the platform supports: Zircuit and Mode.

What is StakeStone's token?

StakeStone's token is STONE, which belongs to the ERC-20 standard and has a non-rebase earning mechanism similar to Lido's wstETH token. Specifically:Token Name: StakeStone

Ticker: STONE

Blockchain: Ethereum

Token Standard: ERC-20

Contract: 0x7122985656e38BDC0302Db86685bb972b145bD3C

Token type: Updating

Total Supply: Updating

Circulating Supply: Updating

In addition to the above information, other information about total supply, total circulating supply, token allocation rate... has not yet been announced by the project smsverificationphone Insights will update you when there is notice.

On March 25, 2024, Binance Labs announced its investment in StakeStone for the development of the project. Information about the capital call or investment amount has not been disclosed.

StakeStone has established partnerships with many projects on the market such as: Hook Protocol, Merlin Chain, Polyhedra... StakeStone develops partnerships with many different projects

Some projects similar to StakeStone include:

Swell: A project about liquid staking, supporting users to stake ETH and receive liquid staking tokens.

Jito: A liquid staking protocol built on the Solana network. Users can stake SOL tokens and receive liquid staking JitoSOL tokens.

So do you understand what StakeStone is? With the amount of knowledge that smsverificationphone provides, we are confident that this is all useful information that we bring.